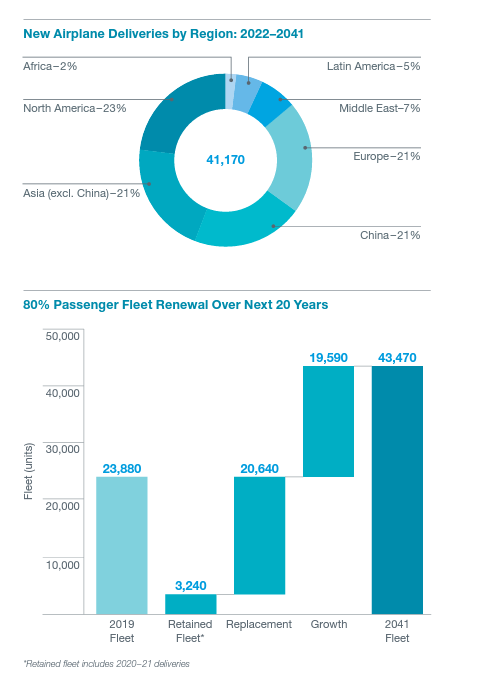

In the run-up to the Farnborough Show, Boeing released its Commercial Market Outlook (CMO) 2022 in which it forecasts that demand for new airplanes will exceed 41,000 units (41,170) in the 2022-2041 period.

The CMO forecasts a market value of $7.2 trillion for new aircraft deliveries, with an 80% increase in the global fleet compared to pre-pandemic 2019 levels. About half of passenger aircraft deliveries will replace current models, improving the fuel efficiency and sustainability of the global fleet.

In addition, Boeing Global Services forecasts demand of 3.6 billion across its market segments during the same period, including strong demand for maintenance and modifications, such as converted freighters; digital solutions that increase efficiency and reduce costs; and for pilots and technicians.

«Despite the unprecedented disruption over the past two years, the aviation industry has shown incredible resilience by adapting to the challenge,» said Ihssane Mounir, senior vice president, Global Sales & Marketing, Boeing Commercial Airplanes.

«Based on our extensive experience in forecasting market trends, the 2022 CMO demonstrates the strong demand for new airplanes and associated services over the coming decades, providing insights as the industry continues to recover,» he added.

The 2022 CMO includes these regional projections over the next 20 years:

- Continuing their strong growth history, Asian markets account for approximately 40% of long-term global demand for new aircraft. Europe and North America each account for just over 20% of demand, with 15% of deliveries coming from other regions.

- The South Asian fleet continues to lead global growth, at 6.2% annually. Led by India, the region’s fleet will nearly quadruple from 700 aircraft in 2019 to more than 2,600 aircraft by 2041. Southeast Asia is forecast to have the second fastest growth with a near tripling of its commercial fleet to 4,500 aircraft.

- Latin America will account for just over 5% of Boeing’s new airplanes in the period, with 2,440 aircraft projected. The services market in the region will reach, according to the CMO, $165 billion.

- Africa, with 1,010 aircraft and $80 billion in services, will account for 2.5% of Boeing’s total market.

- This year’s CMO does not include a forecast for aircraft deliveries in Russia due to sanctions against aircraft exports. This change reduces global 20-year demand by about 1,500 aircraft compared to last year’s CMO.

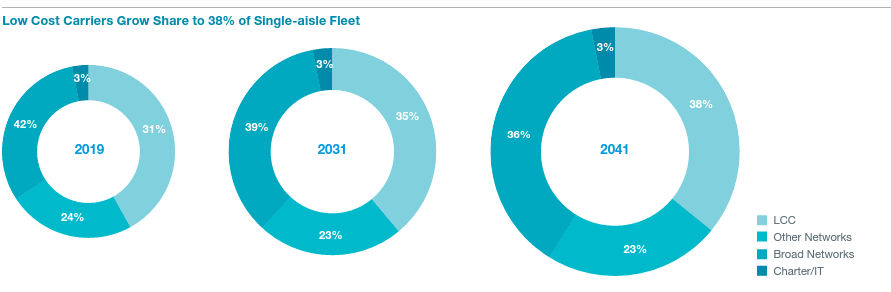

Single-aisle aircraft should total nearly 31,000 aircraft and will account for 75% of all new deliveries – the same rate as last year’s CMO. An interesting detail highlighted by the manufacturer is that Low Cost carriers will increase their share of the single-aisle market to 38%, indicating that, out of every 100 narrow-body aircraft delivered, 42 will be operated by LCCs.

Widebody aircraft will account for approximately 18% of deliveries with more than 7,230 aircraft, enabling airlines to serve new and existing markets, passenger and cargo, more efficiently.

The CMO also predicts continued strong demand for dedicated freighters to support global supply chains and growing express networks. Carriers will need an additional 2,800 freighters, including 940 new widebody models in addition to narrowbody and widebody freighters converted during the forecasted period.

| NEW DELIVERIES (2022-2041) | |

| Regional jet Single aisle Widebody Freighter Total |

2,120 30,880 7,230 940 41,170 |